If a car’s title has a lien on it, it means the vehicle is acting as collateral on a loan. A lien is like a padlock on a vehicle’s title, with the lender (bank, credit union, etc.) holding the key. Until the debt is paid, the lender – not the driver – has final say over who owns the car. Because the lien “travels” with the vehicle, anyone who buys the car before that debt is cleared can lose both the money they paid to the seller and the car itself if the original borrower stops paying.

Modern titling systems complicate matters further. Many states now use Electronic Lien and Title (ELT) programs, in which the DMV keeps the title in a database instead of printing a paper document. A quick glance at a paper title, if one even exists, no longer guarantees you’ll spot an active lien.

Voluntary versus involuntary liens

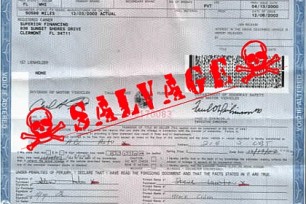

Most used‑car shoppers have heard of voluntary liens, such as the typical auto‑loan lien a bank or credit union records when a buyer finances a car. Less obvious are involuntary liens – claims that arise without the owner’s consent. A repair shop can file a mechanic’s lien when a bill sits unpaid, a judgment creditor can attach a lien after winning a lawsuit, and tax authorities can file a tax lien for unpaid taxes. Each of these encumbrances can remain hidden from a well‑meaning seller and, by extension, from you unless you look for them. Because the lien is attached to the VIN, not the person, it survives every change of hands until it is formally released.Paper titles, electronic titles, and the myth of the visual check

In title‑holding states the lender keeps the paper certificate until the loan is paid off. In non‑title‑holding states the owner receives the paper title, but the lienholder’s name is printed on it. ELT states upend both models. The entire record exists only in a DMV database, so the seller may show you a registration card or an old release letter instead of a title. Unless you tap into that DMV database or a service with access to it, you risk missing an electronic lien that is perfectly valid and fully enforceable.Why a missed lien can gut your purchase

If you buy a vehicle from a seller who already has a lien on the title and the seller defaults on the loan the next day, the lienholder can repossess your “new‑to‑you” car without refunding a dollar. Even if the lender never takes the vehicle, you cannot register the car in your name, insure it properly, or resell it until the lien is satisfied. Worse, you may have to pay off a stranger’s debt just to end the nightmare. Court battles are possible, but they are expensive, slow, and, when the seller is a private individual, often unrecoverable. A 10‑minute lien check is well worth your time to prevent a five‑figure financial loss.A practical, step‑by‑step lien check

Start with the VIN stamped on the dashboard or driver’s door jamb, not the one the seller texts you. Type that VIN into (1) your state DMV’s title‑status portal, if available, and/or (2) the National Motor Vehicle Title Information System ( NMVTIS ) via an approved provider like VIN Lookup or iSeeCars’ VIN History Reports, and/or (3) a paid vehicle‑history report such as Carfax or AutoCheck .Free databases like NICB’s VINCheck are great for theft and salvage data but do not always provide lien coverage. If your state requires an in‑person visit or a small fee for a certified title abstract, make the trip. The document is cheap insurance. Always compare the electronic or printed record with any paper title or release letter the seller offers, and verify the name with the seller’s driver’s license. Discrepancies, no matter how minor, demand an explanation before money changes hands.

Information you need on hand

Besides the VIN, write down the year, make, model, and current odometer reading; take photos of the driver’s license, current registration, and any loan‑payoff statement the seller provides. If you must call a bank to verify payoff, you will need the loan or account number and the seller’s name exactly as it appears on the loan. Skipping any of these details can leave you unable to clear the lien later.ELT States: Going beyond paper

In Florida, California, Michigan, West Virginia, and a growing list of states, the DMV will not mail a paper title until the final lien is released. That means a private‑party seller cannot hand you a certificate even in good faith. Your defense is to obtain an electronic confirmation showing “No Active Liens”: a screen capture, printout, or DMV‑stamped form. Many DMVs provide real‑time electronic receipts, so insist on one.If you discover a lien after you buy a car

First, do not ignore a lien notice. Repossession can happen with no warning. Verify the lien with the DMV, then call the lienholder’s loss‑prevention department. Often they will tell you the exact payoff figure. Next, contact the seller in writing and demand satisfaction of the debt or return of the purchase price. If the seller refuses or disappears, consider small‑claims court (for lower‑price vehicles) or arbitration programs, available in some states. A more complex and time-consuming option is a civil lawsuit for fraud. Be realistic. Suing a broke private seller may cost more than the judgment is worth. Title insurance is nearly nonexistent for motor vehicles, so prevention, not litigation, is your strongest weapon.Negotiating a safe deal on a car with a known lien

When the seller openly discloses a loan, the safest play is to meet together at the financial institution’s branch. You hand the payoff directly to the lender, sign the purchase contract, and have the lender release the lien, and, when possible, sign the title over to you on the spot. If the lender will not provide immediate paperwork, use an escrow service that releases funds only after the lien is shown as satisfied in the DMV system. Avoid “loan assumption” offers unless the lender confirms in writing that it allows transfers and that you are fully approved. Most auto loans prohibit it.State‑specific pitfalls

Every state sets its own rules for lien recording, release signatures, and mechanic’s‑lien enforcement. For instance, Maryland requires a repair bill to be overdue for 30 days before a shop can file a lien, and it forces that shop to publish auction notices in a newspaper. California’s “Car Buyer’s Bill of Rights” gives dealership customers, but not private‑party buyers, a two‑day cooling‑off period on many used‑car purchases under $40,000. Meanwhile, in title‑holding states, absence of a paper title usually indicates an outstanding loan, whereas in non‑title‑holding states you must scrutinize the title itself for the line marked “Lienholder.” Because these differences can make or break your deal, read your own state’s DMV instructions before you start shopping.Reporting fraud and getting help

If a dealer misrepresents a lien, file a complaint with your state’s consumer‑protection agency or Attorney General and, if the advertising was deceptive, with the Federal Trade Commission. Some online marketplaces (e.g., eBay Motors) extend purchase‑protection plans that reimburse undisclosed liens, but coverage terms vary and typically exclude local private sales. Keep every text, email, and document. A paper trail is your leverage.Lien checks are no longer optional paperwork – they are the foundation of a safe used‑car purchase. Get the VIN from the car itself, run it through the state DMV, NMVTIS, and at least one paid history service, and verify any electronic records in real time. Close the deal only when the lender, DMV, and seller all say “no liens.” The minutes you spend confirming the title’s clean status can save your purchase, your money, and your sanity.